Data serves as the nerve center for asset management firms. The securities pricing data, ratings, corporate actions data, NAV etc. are mission critical for asset managers to make the right investment decisions. The compliance team, on the other hand is in need of effective data management to file compliance on time, and avoid penalties.

Most asset management firms incur costs by purchasing data from third-party vendors like Bloomberg, Factset, Rimes, Fitch etc. However, they find it extremely challenging to manage this data, and often fail to leverage it, as this data is unstructured from a holistic perspective.

In the end, asset managers are forced to analyze this unstructured (or semi-structured, in some cases) data and make investment decisions with great difficulty, while the compliance team is forced to file compliance in the nick of time.

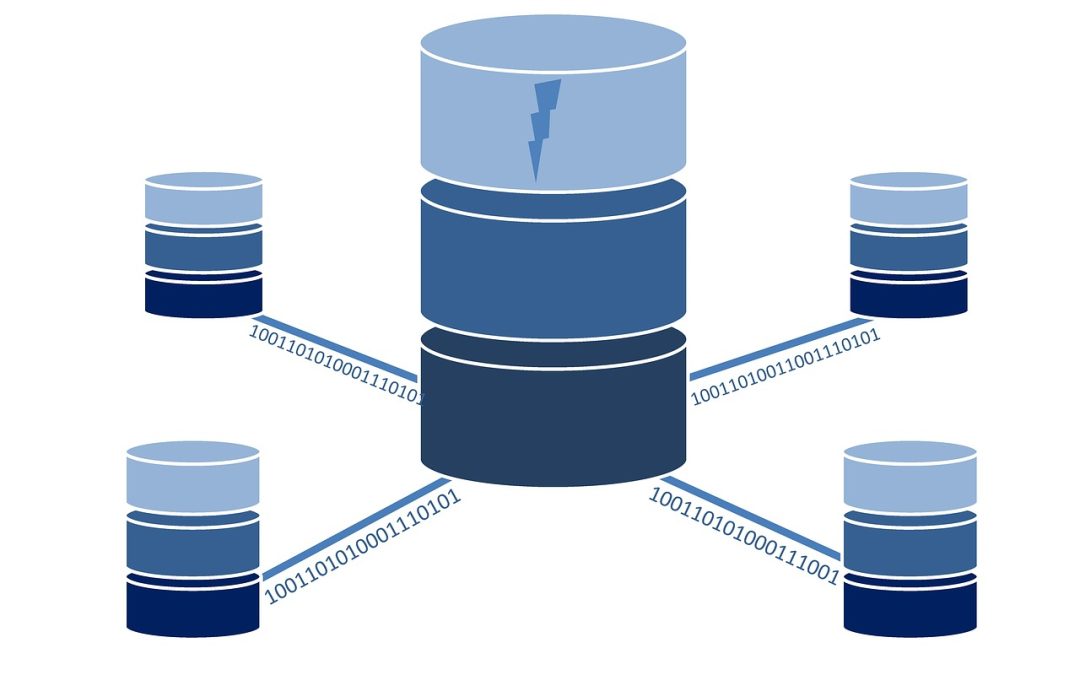

Therefore, effective data management not only acts as a source of competitive advantage, but also as a basic necessity to run an asset management business. The basic foundation of data management in asset management businesses is a centralized data repository (CDR).

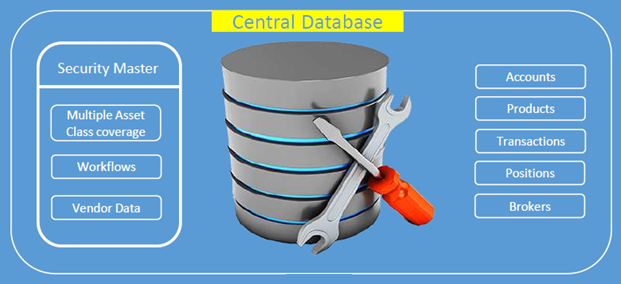

A CDR is comprised of a comprehensive security master being its primary component, that acts as the foundation of other important components – accounts, products, transactions, positions and brokers.